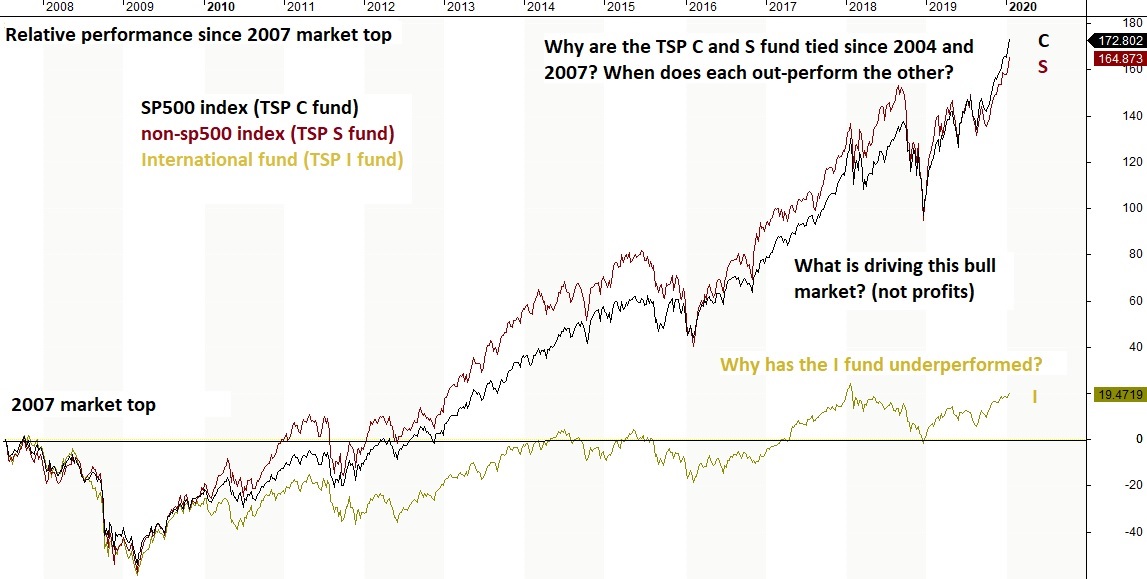

These allocations are known as investment funds. Losses during bear markets or large market corrections.

Tsp Allocation Strategies 2021 The Best Out There Rich On Money

Tsp Allocation Strategies 2021 The Best Out There Rich On Money

18022021 To simplify the TSP match formula a government employee or military service member can maximize the TSP match by contributing at least 5 of base pay.

Best way to allocate tsp funds. Below is a list of different potential TSP allocation strategies to show you how to invest in the TSP in 2021. You want a risk efficient. Contribute at least 5 of your pay to get another 5 in matching contributions from the government.

16072014 This includes setting up your Thrift Savings Plan TSP which allows you to make tax-deferred contributions a portion of which is matched by the government. This means that if youre putting 5 of. Please send me your recommendations with.

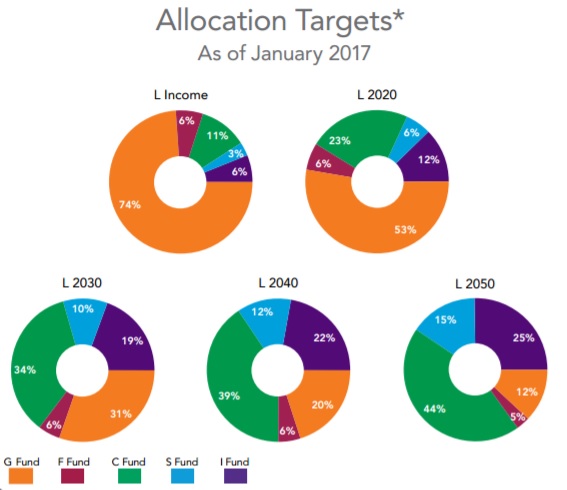

The Lifecycle funds are diversified and automatically re-balance themselves so they require the least hands-on management to get solid returns. Even young investors should sit in the TSP G fund while waiting out market resets. The best TSP strategy requires a better understanding of TSP funds to eliminate the weaker funds.

This is my third update since late 2019. Ive pulled these from various sources and as I discover new ones I will update this. For example you can put 70 of your money in stock and 30 in bonds or 60 in stock and 30 in bonds and 10 in cash equivalents.

02112020 Fund Last YTD. This will ensure the maximum match of 5 from the government. You may take partial TSP withdrawals every 30 days or you can take a full withdrawal.

The TSP funds have not changed my strategy of avoiding significant losses has not changed but the investing environment has and so must your allocations if your retirement nest egg is to survive. 25062015 An asset allocation would involve you deciding what percentage of your money should be in the C fund what percentage in S fund G fund I fund and F fund. 22012020 Contribution matching refers to the amount of money your employer will put in your TSP relative to your contribution.

Your agency will contribute a 100 match for contributions you make up to 3 of your basic salary and a 50 match for any contributions from 4 to 5 of your basic salary. I would not recommend 100 in any one fund. How you choose to allocate your investments in the TSP is ultimately yours but as this young man realized and Ric Edelman confirmed keeping your investment too conservative could cost you a lot of money over the long haul.

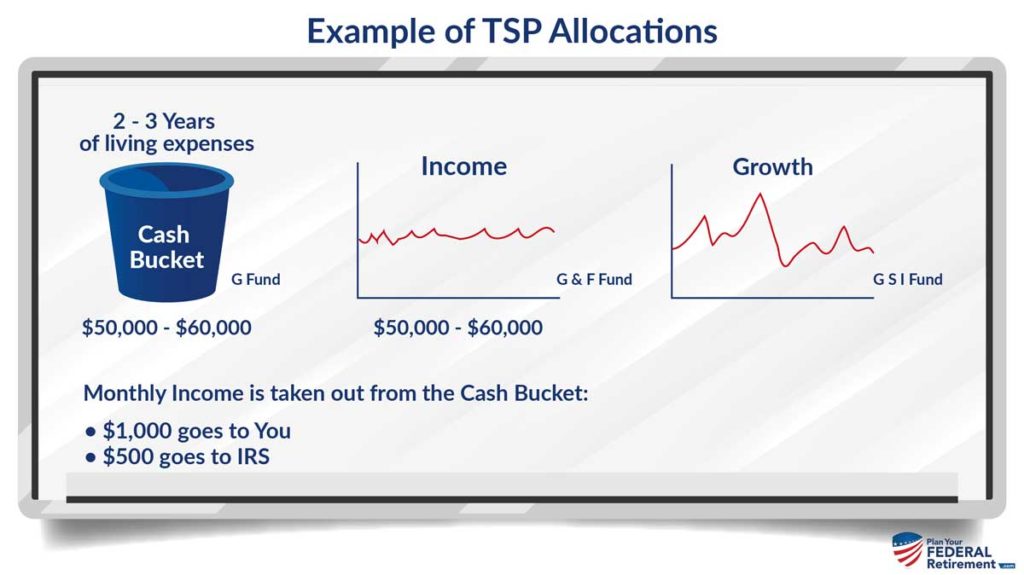

Denial is in the air. 02032020 The Best TSP Withdrawal Strategies There are several different ways to withdraw money from your TSP but you must begin taking required minimum distributions RMD no later than April 1st of the year after you turn 705. While there are some strategies to optimize your TSP allocation my default recommendation to most people is to put their money into one of the appropriate Lifecycle funds.

It gives you the opportunity to earn rates of interest similar to those of long-term Government securities with no risk of loss of principal. The TSP Model is designed to keep your account allocated to the strongest performing funds. The TSP has five individual investment funds.

Equity funds stocks come with significant downside risks ie. The Government Securities Investment G Fund The G Fund has investments in short-term US. We call this the water cooler theory Meaning you get to visit with your co-worker about the TSP and one party is or has done better than the other so the other party changes their allocations to match.

Dont follow the herd. 24042020 TSP Allocation Guide Coronavirus Update. 13062014 Ramsey suggests either 80 or 60 in the C fund and then spreading the remaining portion evenly in the S and I funds but the three funds he recommends are the same as what Ric Edelman suggested.

Allocating your TSP according to your co-worker we see this application more than we care to. The best TSP allocation strategy is simple to execute and low risk. Cash equivalents Treasury bills and money market funds Deciding the asset allocation of your TSP means you pick how much of your money you want to invest in each of those three.

After retirement you cant contribute additional funds to your account and as one fund grows faster than the other that funds balance will show a larger percentage of your total account balance. If you are enrolled or are eligible to enroll in the TSP the TSP Allocation Model TSP Model can help you earn higher returns while taking on less risk. The most important decision you have to make is when to shift your allocations between either of the US equity funds and the TSP G fund.

25012018 A good way to check this is to review your TSP statement and look at the Distribution of Account column. 29072020 What is the ideal allocation of the TSP. Unlike others we believe lower risk while result in larger nest egg in the long run.

Recommended Tsp Allocations Plan Your Federal Retirement

Recommended Tsp Allocations Plan Your Federal Retirement

Tsp Pilot Login Login To Tsppilot Com Online Pilot Login Tsp

Tsp Pilot Login Login To Tsppilot Com Online Pilot Login Tsp

Tsp Allocation Strategies 2021 The Best Out There Rich On Money

Tsp Allocation Strategies 2021 The Best Out There Rich On Money

Tsp Allocation Strategies 2021 The Best Out There Rich On Money

Tsp Allocation Strategies 2021 The Best Out There Rich On Money

Https Www Sec Gov Investor Your Tsp Account 2020 Slides Pdf

I Keep Trying And Failing To Time The Market With My Tsp What Am I Doing Wrong Stock Market Day Trading Forex Trading Tips

I Keep Trying And Failing To Time The Market With My Tsp What Am I Doing Wrong Stock Market Day Trading Forex Trading Tips

Tsp Allocation Strategies 2021 The Best Out There Rich On Money

Tsp Allocation Strategies 2021 The Best Out There Rich On Money

Why Buying Gold And How To Invest 25000 In Gold Buying Gold Investing Gold Bullion

Why Buying Gold And How To Invest 25000 In Gold Buying Gold Investing Gold Bullion

Arabic Pizza Manakeesh Middle Eastern Foods Food Arabic Food Syrian Food

Arabic Pizza Manakeesh Middle Eastern Foods Food Arabic Food Syrian Food

How To Manage Your Tsp Like You Want To Be Rich The Military Money Expert Military Retirement Military Family Life Retirement Money

How To Manage Your Tsp Like You Want To Be Rich The Military Money Expert Military Retirement Military Family Life Retirement Money

Https Www Sec Gov Investor Your Tsp Account 2020 Slides Pdf

The Military Financial Planner Fee Only Financial Planning For Military Families Investing Financial Planner Financial Planning

The Military Financial Planner Fee Only Financial Planning For Military Families Investing Financial Planner Financial Planning

Holiday Travel Health Insurance Our Deer Travel Health Insurance Travel Health Holiday Travel

Holiday Travel Health Insurance Our Deer Travel Health Insurance Travel Health Holiday Travel

Tsp Allocation Strategies 2021 The Best Out There Rich On Money

Tsp Allocation Strategies 2021 The Best Out There Rich On Money

2014 08 Investing All Along The Risk Return Spectrum Investing Financial Advice Corporate Bonds

2014 08 Investing All Along The Risk Return Spectrum Investing Financial Advice Corporate Bonds

Post a Comment

Post a Comment